The UK has witnessed a significant rise in a sophisticated form of financial deception known as “pig butchering” scams. Unlike conventional scams that seek immediate gains, pig butchering is methodical. Exploiting victims’ trust and emotional investment over time before defrauding them of substantial amounts of money.

In response to the rising tide of pig butchering, adopting a cautious and informed approach to online interactions is essential.

The Mechanics of Pig Butchering Scams

Pig butchering scams begin with seemingly innocent interactions, often initiated on social media platforms or dating apps. The fraudster, masquerading as a potential friend or romantic interest, gradually builds a rapport with the target. Through expert manipulation and the creation of a believable narrative, the fraudster introduces a lucrative investment opportunity, promising low-risk and high returns. Trusting in the relationship they think they have built, victims are persuaded to invest. Leading to significant financial losses when the fraudster inevitably disappears.

In the UK, financial watchdogs have raised alarms about the growing prevalence of pig butchering scams. However, specific statistics are challenging to isolate within the broader category of all fraud. The Financial Conduct Authority (FCA) reported losses of millions of pounds annually due to various investment scams, with pig butchering contributing to these figures.

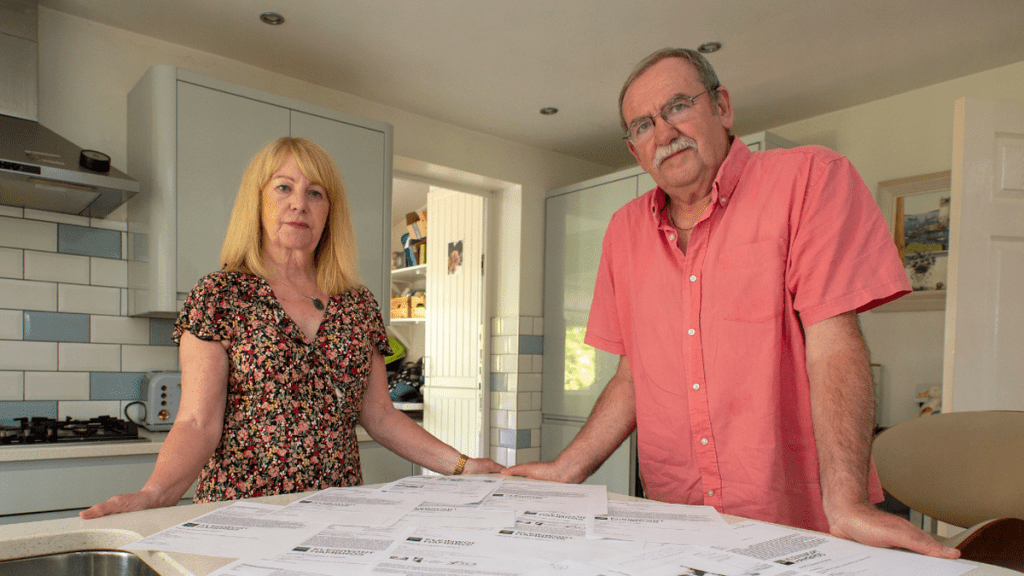

The Emotional Toll on Victims

The psychological impact of falling victim to a pig butchering scam extends far beyond the initial shock and financial hardship. The intricate web of deceit spun by fraudsters leaves individuals questioning their judgment and suffering from a crisis of confidence. This emotional turmoil manifests in long-term mental health issues, including anxiety disorders and chronic stress, as victims grapple with the repercussions of the betrayal. The isolation felt from being trapped in such a scam is exacerbated by the stigma associated with falling victim to fraud. This makes individuals reluctant to seek help or share their experiences.

This silence can hinder the healing process, as victims struggle alone, without the support network that is crucial for recovery. The deep-seated loss of trust can affect personal and professional relationships. Leaving lasting scars on the victim’s ability to form new connections. This complex emotional aftermath underscores the need for comprehensive support systems to help victims navigate the challenging journey towards recovery.

Verify and Validate

Approaching unsolicited investment opportunities with scepticism is more than just caution. It’s a necessary strategy in today’s digital world, where fraudsters use sophisticated techniques to appear legitimate. Verifying the identity of individuals and the authenticity of their proposals requires diligent research. Leveraging online tools and resources, such as official regulatory websites, scam alert forums, and financial advisory services, can offer invaluable insights into the credibility of these opportunities.

Additionally, consulting with financial experts or advisors before making any investment can provide an extra layer of security. This approach to online investments is essential in navigating the digital landscape safely, ensuring that you make informed decisions that protect your financial and emotional well-being.

Emotional Caution and Awareness

The emotional manipulation inherent in pig butchering scams exploits the very essence of human vulnerability. These fraudsters are adept at creating scenarios that resonate with our deepest desires for connection and financial prosperity, making it easy to overlook red flags. It’s crucial to remain vigilant, critically evaluating the progression of online relationships and the feasibility of financial promises made.

This includes paying attention to how quickly someone tries to deepen the relationship or push for financial involvement. Setting boundaries and seeking external perspectives from friends or family about new online relationships can provide a reality check against potential manipulation. Recognising and resisting these emotional manipulations is critical to safeguarding oneself against the deceitful tactics employed by fraudsters.

Educate and Advocate

Awareness and education play pivotal roles in the collective effort to combat fraud. By familiarising yourself with the hallmarks of pig butchering scams, you empower not only yourself but also those around you. The UK government, alongside financial institutions, actively develops resources and campaigns to enlighten the public about the dangers of financial scams.

These resources often include guidance on recognising scam tactics, steps to take if you suspect you’re being targeted, and how to report fraud. Sharing this knowledge within your community amplifies the impact, creating an informed populace that is harder for fraudsters to deceive. Community forums, social media, and educational workshops can serve as platforms for spreading awareness. Fostering an environment where individuals are equipped to recognise and resist fraudulent schemes effectively.

Reporting and Recovery

If you suspect you have been targeted by a pig butchering scam, it is crucial to report it immediately. Victims can report to Action Fraud, the national reporting centre for fraud, operated by the City of London Police. While recovering lost funds can be challenging, early reporting increases the chances of tracing the fraudsters and potentially recuperating some of the financial losses.

The rise of pig butchering scams in the UK is a concerning trend, underscoring the need for vigilance, education, and protective measures in our digital interactions. By staying informed and cautious, individuals can safeguard themselves against the emotional and financial devastation of these scams. We must evolve our strategies to protect our financial and emotional well-being as digital platforms continue to evolve, facing ever-more sophisticated forms of fraud.