A Devon taxi driver has been jailed for fraudulently obtaining two government-backed Covid loans. Murat Dogantekin, 50, overstated his annual turnover by more than £350,000. He secured loans far above what he was eligible for and misused the funds. His actions have led to a significant jail sentence and a warning to others who might try similar schemes.

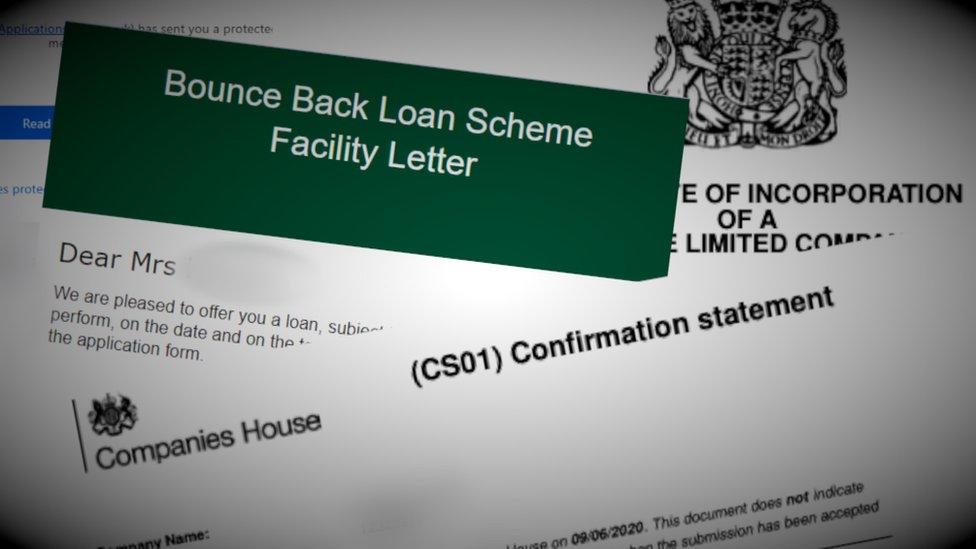

The Scheme Explained

The government introduced the Bounce Back Loan Scheme (BBLS) to help small and medium-sized businesses during the Covid pandemic. Under this scheme, eligible businesses could borrow up to 25% of their annual turnover, with a maximum limit of £50,000. The scheme allowed only one loan per business. This measure aimed to support businesses facing a sudden loss of income during the crisis.

In May and June 2020, Dogantekin submitted two separate loan applications. He claimed to run two self-employed taxi businesses. In these applications, he declared turnovers of £200,000 and £205,000. However, his actual earnings for the tax year ending in April 2020 were only £16,500. This vast difference allowed him to appear eligible for much larger loans.

Investigators later discovered that Dogantekin’s second business, operating under the name “Ola Taxis,” was not genuine. The name came from one of his clients. It did not exist as a separate entity. Had he been honest about his earnings, he would have qualified for a single loan of about £4,125. Instead, he fraudulently secured an extra £95,875 in government support.

Misuse of Funds

After receiving the first £50,000 loan, Dogantekin quickly misused the funds. Within days, he transferred £49,500 to another bank account, recording the transaction as a “shop purchase.” The following day, he moved £48,000 to an offshore bank account, raising suspicions.

The second £50,000 loan stayed in his business account for over a month. Over six days, he transferred this money to a family member and into another account. Dogantekin did not use any of the Covid loans to support his taxi business. Instead, he diverted the money for personal gain. This misuse of public funds led to his eventual bankruptcy in November 2021.

Investigation and Arrest

After being declared bankrupt, Dogantekin was questioned by the Insolvency Service’s Official Receiver in November 2021. He provided limited documentation during this questioning. The investigation then faced further challenges. Dogantekin ignored 11 subsequent attempts to contact him and failed to attend an interview under caution. His lack of cooperation only added to the evidence against him.

Mark Stephens, chief investigator at the Insolvency Service, condemned Dogantekin’s actions. He said, “Bounce-back loans were created to support small and medium-sized businesses through the pandemic. They were not designed to be accessed by fraudsters.” Stephens stressed that Dogantekin broke the rules of the scheme. He obtained two loans when businesses were only entitled to one and failed to use the funds for his business. Stephens added, “His deliberate misuse of public funds will not be tolerated, and we will continue to take action against those who stole from the taxpayer during a national emergency.”

Dogantekin appeared at Exeter Crown Court on February 27. He faced charges related to theft and fraud. The court heard that he overstated his earnings significantly in order to obtain the loans. After a thorough trial, the judge sentenced him to two years and seven months in prison. The sentence reflects the serious nature of his crimes and the clear misuse of a government support scheme.

Impact on Public Funds

The Bounce Back Loan Scheme has been a lifeline for many businesses during the Covid pandemic. However, cases like Dogantekin’s undermine its purpose. According to government figures, businesses have drawn a total of £46.5 billion in bounce-back loans. Out of this, borrowers have fully repaid £24.3 billion. Despite this, £1.37 billion remains in arrears, and about £380 million in loans have defaulted.

This case serves as a stark reminder of the need for strict measures. The government continues to monitor and act against fraud. The Insolvency Service is now seeking to recover the fraudulently obtained funds under the Proceeds of Crime Act 2002. Recovery of these funds is vital to restore trust in public support schemes.

This case highlights the importance of integrity in public support schemes. During the pandemic, the Bounce Back Loan Scheme was designed to help those in need. Dogantekin’s actions not only abused the system but also harmed the trust placed in government support programs. His scam deprived eligible businesses of crucial resources.

The government sends a clear message by taking strict action against such crimes: Fraudulent behaviour will face consequences. Authorities are committed to protecting taxpayer money and ensuring that support reaches those who need it. Recovering misused funds also plays a significant role in maintaining public confidence in financial support systems.

Food for Thought

Murat Dogantekin’s case serves as a warning to all who might consider committing fraud. He overstated his earnings and secured loans far beyond his eligibility. His actions led to significant financial misappropriation and a prison sentence of two years and seven months.

Fraud undermines the trust that businesses and the public have in these support programs. Authorities and financial institutions must work together to prevent such misuse. Similar scams can be curtailed by improving data verification, monitoring fund transfers, and tightening loan conditions.

The lessons from this case are clear. Fraudsters who abuse public funds will be pursued, and authorities will recover misappropriated funds under the Proceeds of Crime Act 2002. These actions help restore confidence in public support measures.