Ben Hamilton was given a suspended sentence after being convicted for fraudulently abusing the Bounce Back Loan scheme. This case highlights the need for increased vigilance against loan fraud and more robust measures to protect victims of fraud.

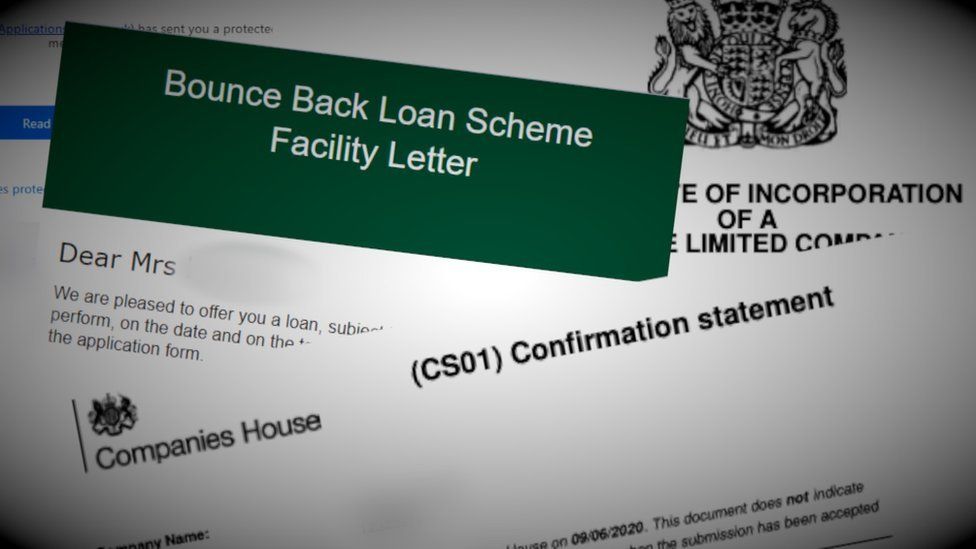

The UK government introduced the Bounce Back Loan Scheme (BBLS) as a response to the challenges posed by the pandemic. The scheme aimed to support struggling businesses financially by offering loans of up to £50,000, with a 100% government guarantee. However, the BBLS has been exploited by fraudsters, resulting in a significant number of cases and financial losses.

Fraudulent Loan Application and Company Dissolution

According to the National Audit Office, it is estimated that the losses from the BBLS could be £5 billion. This figure accounts for loans that may not be repaid due to borrowers defaulting or fraud. The British Business Bank warned the government of the increased risk of fraud due to the scheme’s design. Which prioritised speedy loan approvals and disbursal over thorough borrower checks.

The NAO report also highlighted that as of September 2021, approximately 26,933 loans were suspected of being fraudulent. This number is believed to be an underestimate, as the actual figure may be higher due to unreported cases.

In May 2020, Hamilton applied for a £25,000 loan from his bank on behalf of Netelco Ltd. The Bounce Back Loan scheme was introduced to support businesses facing financial hardships due to the pandemic lockdowns. Upon approval, the loan was paid into the company’s account on May 14, 2020.

However, the very next day, Hamilton filed papers with Companies House to dissolve Netelco Ltd. A crucial aspect of the dissolution process involves informing any banks or building societies with which the company has loans of the intention to dissolve. Hamilton failed to do this, despite the clear warning that failure to report such information is a criminal offence.

Government Counter-Fraud Investigation Identifies Suspicious Activity

The circumstances surrounding Netelco Ltd’s dissolution raised suspicion. Leading to the case being flagged as a potential Bounce Back Loan fraud by the government counter-fraud work. Hamilton initially refused to cooperate with the Insolvency Service team investigators and did not attend the scheduled interviews. Only after the Insolvency Service placed a restraining order on his bank accounts did Hamilton decide to cooperate, speak to investigators, and eventually repay the £25,000 loan in full.

Hamilton pleaded guilty to charges under the Companies Act 2006 at Teesside Magistrates Court on October 14. Along with his suspended prison sentence of just over a year, he was also ordered to pay £2,500 in costs.

UK’s Approach to Fraud Cases Requires Strengthening

While the outcome of this case led to a conviction, it also demonstrates the UK’s lenient stance on fraud. Hamilton managed to exploit a government-backed scheme aimed at assisting struggling businesses and walked free from court, raising concerns about the effectiveness of the UK’s fraud prevention measures.

The fact that Hamilton repaid the fraudulently obtained loan should not have impacted the case’s outcome, as a crime was still committed. Unless the UK begins treating fraud cases with the same gravity as other offences, the number of cases, the total money stolen, and the number of victims of fraud will continue to escalate.

The Importance of Reporting Fraud

Given the potential for significant financial losses and the increasing prevalence of loan fraud, it is crucial for individuals and businesses to be vigilant and report fraud whenever they suspect it. Reporting fraud not only helps protect potential victims but also aids in holding the perpetrators accountable.

Victims of fraud or those suspecting fraudulent activities should contact the relevant authorities, such as the UK’s Action Fraud, to ensure appropriate action. Individuals, businesses, and government agencies can create a more secure environment and reduce the risk of further fraud cases by working together.

To combat the rising instances of loan fraud and to protect potential victims of fraud, it is essential that the UK strengthens its approach to fraud prevention and invests in more robust measures to detect and report fraud. Until such changes are implemented, UK businesses and citizens remain vulnerable to exploitation by fraudsters.