It is a nightmare come to life. Thousands of EasyJet customers found themselves trapped in foreign lands during the August bank holiday due to a massive meltdown in the UK’s air traffic control system. Approximately 1,500 flights were cancelled, leaving airlines scrambling to assist their stranded customers. The chaos didn’t just inconvenience travellers; it also opened the door for fraudsters to exploit the situation, making the need for fraud awareness more pressing than ever.

Social Media: The Hacker’s Playground

The situation was already stressful for those stranded overseas. Still, it turned more sinister when fraudsters started creating lookalike social media accounts posing as EasyJet. These fake accounts reached out to customers who had publicly requested assistance from EasyJet on platforms like Twitter. The goal was simple yet nefarious: lure these individuals into divulging personal information such as their phone numbers and email addresses, thus turning them into victims of fraud.

The Predatory Tactics of Fraudsters

One couple, Iain Hawthorn and Lucy Chang—who is six months pregnant—fell victim to this deceptive scheme. Stranded in Rhodes with all EasyJet flights to Gatwick sold out until the next week, they took to social media to voice their complaints. That’s when the fraudsters saw their chance. Posing as EasyJet, they contacted the couple through three separate fake accounts.

What followed was even more insidious. Ms Chang received a phone call from a Tanzanian number, pretending to be an EasyJet customer service agent. The scammer requested that they send their flight and accommodation receipts via WhatsApp, an offer they wisely declined. The couple stated that given the chaos and EasyJet’s lack of support, it’s not difficult to see how people can fall for scams like this.

The Failing Safeguards

Surprisingly, EasyJet has yet to issue any communications advising its customers to be cautious. Not a single announcement to inform customers about the fraudulent activity or to provide guidelines on interacting only with verified EasyJet social media accounts or official phone numbers. This lapse has only fueled the fire, making it easier for fraudsters to continue their scams and underlining EasyJet’s failure to protect its passengers.

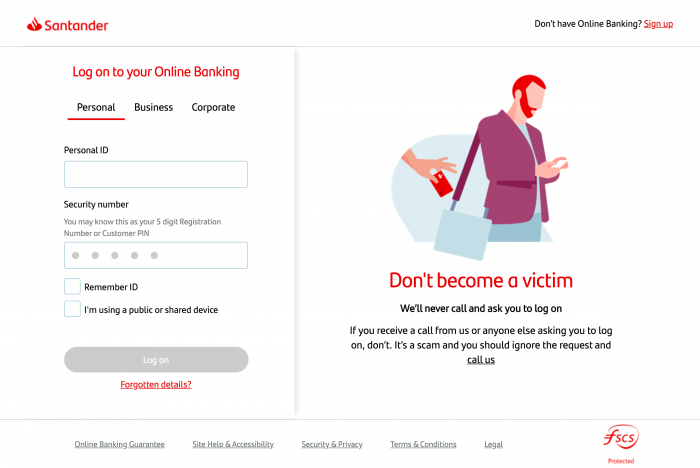

In most cases of fraud, the strongest line of defence is yourself. While you might assume it’s the duty of companies like EasyJet to protect you, the reality is that you can’t solely rely on them. Especially in high-stress situations, it’s essential to remain vigilant. These are the moments fraudsters often choose to strike, capitalising on your vulnerability. Being proactive and aware can make all the difference in preventing you from becoming a fraud victim.

The Importance of Pre-Emptive Action

Several other customers of EasyJet have also raised the alarm on social media. One alerted the airline to a scam attempt that could have cost them £330, while another highlighted the risk of becoming a fraud victim due to EasyJet’s poor communication. The common thread in these complaints? EasyJet urgently needs to take proactive measures to protect its customers from fraudsters carrying out these scams.

This incident underscores the critical importance of fraud awareness and prevention. As the most common crime in the UK, fraud can have a devastating impact not just on your finances but also on your emotional well-being. It is, therefore, vital that both companies and individuals take pre-emptive measures to protect themselves from falling victim to scams.

Don’t Wait to Become a Victim

The time to act is now. As many have learned the hard way, people tend to ignore the risk of fraud until it’s too late. Don’t wait until you’re a fraud victim to take action. Recognise fraud for the crime that it is, and protect not just your money but also your peace of mind. Let this incident be a wake-up call to airlines, customers, and companies alike. Fraud is not a hypothetical threat; it’s a real and present danger that requires immediate and constant vigilance.