The landscape of financial security is increasingly besieged by sophisticated fraudsters, employing tactics that exploit trust to siphon billions from the unsuspecting public. As the most prevalent crime in the UK, understanding and implementing fraud prevention and awareness strategies has never been more crucial.

In this era, where online transactions have become the norm, the avenues for deception have multiplied. Making it easier for fraudsters to mask their true intentions behind the veil of technology. This calls for a heightened awareness and a proactive approach to safeguarding personal and financial information. From verifying the authenticity of communication to understanding the signs of fraudulent activities, equipping oneself with knowledge and tools for fraud prevention is an indispensable defence in this ongoing battle for financial security.

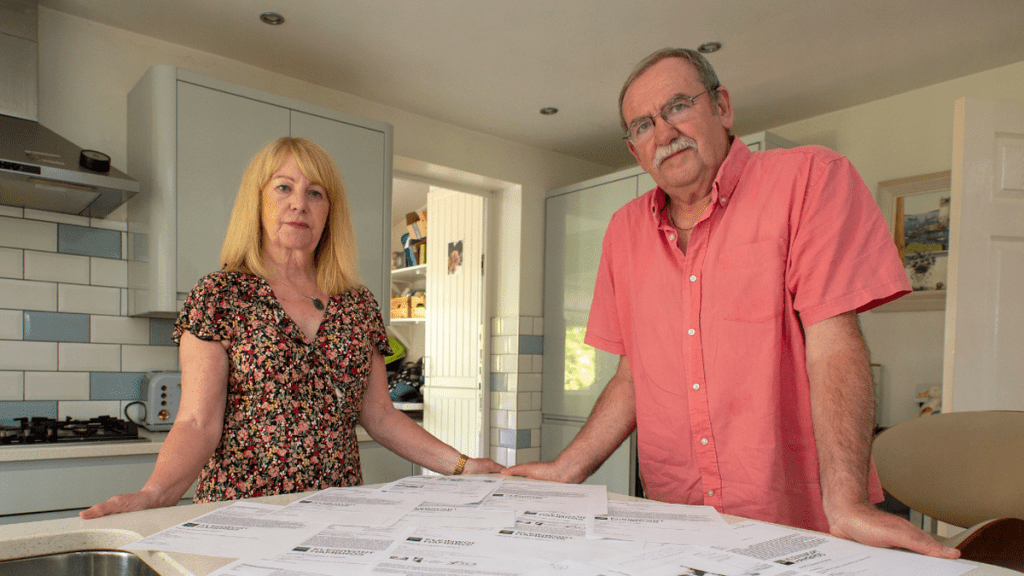

The Rising Wave of Impersonation Scams

Last year, £7.5 billion was stolen from the pockets of citizens, with impersonation and identity scams representing the lion’s share. These scams, accounting for approximately 70% of the 400,000 incidents reported to the National Fraud Database, underscore the urgent need for heightened vigilance.

Impersonation scams have witnessed a significant surge, escalating by 13% as perpetrators refine their deceitful techniques. By masquerading as bank officials, police officers, or even loved ones, fraudsters have mastered the art of manipulation, accessing and draining victims’ bank accounts with alarming proficiency.

Strategies to Counteract Fraudulent Schemes

The fight against fraud is not without hope. Measures rooted in caution and informed scepticism are key to safeguarding your financial well-being. Here are pivotal strategies:

- Exercise Caution with Unsolicited Contacts: Scrutinise phone calls or messages from unfamiliar sources. Genuine banks or law enforcement officials will never compel you to transfer funds or download suspicious software.

- Identify and Report Impersonation Scams: Lloyds Bank highlights a notable rise in scams involving impersonators of police or bank staff. These fraudsters often concoct scenarios involving ‘safe account’ transfers or participation in fictitious police investigations to trap their victims.

- Stay Informed on the Tactics of Fraudsters: Although the average loss from such scams has decreased, the emotional and financial toll remains significant. CEO fraud, for instance, stands out for its high average loss, duping employees into making unauthorised payments under the guise of urgent company directives.

The Evolving Face of Fraud

Beyond traditional impersonation methods, fraudsters are diversifying their approaches. Amazon and other reputable brands have become familiar facades for scams, exploiting their widespread consumer base. Moreover, the digital age has seen a rise in more personalised deceit, with criminals posing as tradespeople to gain trust and access to personal financial information.

By alleging issues with accounts or promising refunds, fraudsters craft elaborate ruses to steal personal data. Additionally, the shift towards more personalised scams marks a worrying trend. Criminals masquerading as local tradespeople, leverage the guise of everyday services to infiltrate the personal lives of their victims. This approach breaches financial security and erodes community trust. Making it imperative for individuals to remain vigilant and question the authenticity of unsolicited offers or services.

A Call to Action for Fraud Awareness

The escalating sophistication of fraudsters necessitates a proactive and well-informed response from all of us. Firstly, by fostering awareness, then by exercising caution in digital communications, and finally, by reporting suspicious activities, we are able to collectively stem the tide of this financial scourge. The essence of combating fraud lies in responding to victimisation and preempting potential threats through education and vigilance.

Moreover, impersonation scams are becoming increasingly prevalent. Consequently, grasping the mechanics of fraud prevention and enhancing fraud awareness are crucial in safeguarding your financial health.