Former London firefighter Catherine Mulalley, now residing in New Zealand, fell victim to a sophisticated pension scam, wiping out her life savings of over £170,000.

A Deceptive Introduction to Investment

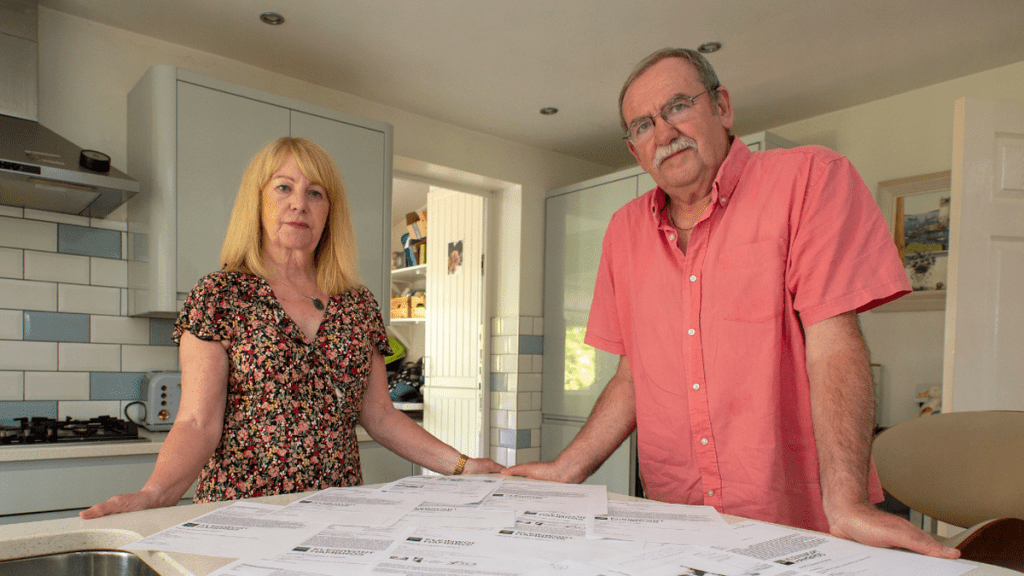

Mulalley, who served the London Fire Brigade for 15 years, aspired to build her dream home using her pension savings. However, the scam has shattered her dreams, forcing her to envision working well into her 60s for survival.

The ordeal began when Mulalley, a native of Staines, sought investment opportunities online. Shortly after, she received a call from an individual purporting to represent Citibank. The caller provided convincing paperwork and credentials for a Citibank branch in Auckland upon request.

The Ill-fated Transaction

Convinced by the authentic-looking credentials, Mulalley proceeded to her local Bank of New Zealand branch to transfer her funds, assisted by bank staff who didn’t raise any suspicions about the transaction. A few days later, a message arrived informing her of a payment issue, promising a refund that never materialised. The police later confirmed the funds were fraudulently transferred to a Hong Kong bank account.

While £35,500 of her savings were recovered, the remaining £134,500 seems lost forever. The financial setback has left Catherine contemplating a prolonged working life, with the hopes of securing a mortgage on her ageing home appearing bleak.

The Genesis of The Nightmare

Mulalley traces the scam back to her inquiry into life insurance for her husband, who was sidelined by a severe neck injury. The inquiry opened a pandora’s box of fraudulent financial offerings advertised at enticingly better rates than industry standards. Upon expressing interest, fraudsters engaged her over the phone, expertly building rapport to make the “investment” seem trustworthy.

The allure of high returns veiled the true nature of this scam, underscoring the importance of in-person interactions when making significant financial decisions. Rapid decisions over the phone or via email often lead to grievous financial losses.

Bank’s Stance and Lessons for The UK

The Bank of New Zealand denied refunding Catherine, as she needed to verify the transaction using genuine contact information. This incident serves as a stark reminder for individuals in the UK and beyond about the crucial role of due diligence before parting with hard-earned money, even when bank staff don’t flag a transaction as suspicious.

This harrowing experience sheds light on the sinister tactics employed by fraudsters. It emphasises the imperative of personal vigilance in safeguarding one’s financial assets, especially in the face of seemingly attractive investment opportunities.

Strategies for Safer Investing

Whenever an investment opportunity appears too good to be true, it likely is. It’s always prudent to steer clear of such propositions since the majority turn out to be scams. It’s also wise to avoid investments advertising returns significantly above the average, as these inflated returns are a tactic fraudsters employ to entrap unsuspecting individuals.

Always consult a financial adviser before making any financial commitments. Additionally, you can utilise the FCA register to ascertain a company’s trustworthiness. It’s also beneficial to investigate if a company has faced fraud accusations in the past, enabling you to make an informed decision.