A rise in fraud has seen a 29% increase in individuals over 40 being exploited as money mules. Despite this, younger demographics, particularly those under 24, are still the most likely to be involved in these schemes. Many are unaware that acting as a money mule can lead to severe consequences, including a potential 14-year prison sentence.

Surprisingly, one in ten people admit they would consider moving money through their accounts, highlighting gaps in fraud awareness. This underscores the urgent need for enhanced fraud prevention strategies to safeguard individuals across all age groups.

Understanding the Role of a Money Mule

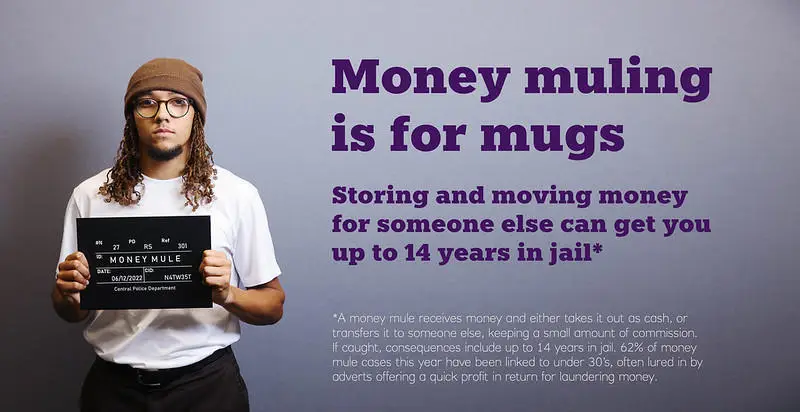

A money mule is an individual who transfers money acquired illegally, often unknowingly, under the guidance of someone else. These transactions may appear harmless or even beneficial to the mule, who is typically promised a share of the money for their “services.” Fraudsters recruit through various channels, including job advertisements, emails, or social media platforms, presenting opportunities that seem too good to ignore.

Fraudsters employ compelling tactics to recruit money mules. They might advertise fake job offers for “financial managers” or “overseas representatives,” promising substantial earnings for minimal effort. Alternatively, they might reach out directly via email or social media, preying on those who are financially vulnerable or unaware of such scams.

The Legal and Financial Repercussions

Becoming a money mule, intentionally or otherwise, has severe implications. Legal consequences can range from the freezing of bank accounts to criminal charges leading to 14 years imprisonment. Being involved in such scams can cause irreversible damage to one’s financial situation.

Upon detection of suspicious activity, banks may freeze accounts associated with money muling to prevent further unlawful transactions. This action can disrupt personal finances and lead to significant hardships, particularly if one’s salary or essential payments pass through the frozen account.

The Scale of the Problem

The long-term repercussions extend beyond immediate financial disruption. Individuals identified as money mules often find it challenging to secure loans, mortgages, or even open new bank accounts. The criminal record that accompanies such activities can hinder professional opportunities and damage personal relationships and reputations.

Recent statistics from UK fraud prevention agencies highlight a worrying trend. Reports from 2022 indicate a 33% increase in the recruitment of money mules among individuals under 30 compared to the previous year. Economic hardships caused by global events are driving more people toward seemingly easy money-making schemes.

Vulnerable Groups

Digital platforms are increasingly targeting young people, particularly students and those in the early stages of their careers. The promise of easy money combined with a lack of awareness about the legal implications makes this group particularly susceptible to becoming money mules.

Raising awareness and educating the public about the dangers of money muling are crucial steps in combating this issue. Here are some effective fraud prevention measures:

- Education and Awareness Campaigns: Regular campaigns by banks, educational institutions, and law enforcement can alert individuals to the signs of being recruited as a money mule.

- Verification Processes: Before engaging in any job that involves handling money, especially from abroad, verify the legitimacy of the company and job offer.

- Monitoring and Reporting: Vigilant monitoring of personal bank accounts for any unusual activities is essential. Early reporting can prevent the severe consequences of money muling.

Case Study

Sarah received an unexpected phone call from her colleague, Jessica, who urgently needed her assistance. An individual claiming to be from eBay approached Jessica, stating that Jessica was entitled to a refund of £12,000 for some past transactions. The person on the line instructed Jessica to install an app on her smartphone to facilitate the refund process. Jessica followed the instructions, allowing the caller remote access to her device and, consequently, to her online banking.

Jessica watched as the caller deposited £12,000 into her bank account. However, the caller quickly reported a ‘technical difficulty’ and insisted on transferring the money through several other accounts to resolve the issue. Jessica’s only task was to contact her friend Sarah, explain she was facing an ‘online banking issue’, and give her the details for another account to send the £12,000.

Sarah agreed to help and soon received the funds, as instructed by Jessica, via the caller, who still controlled Jessica’s device remotely. However, when Sarah attempted to move the funds on, the bank detected suspicious activity. The authorities received reports on both individuals, and they successfully blocked the movement of the funds through the financial system.

The supposed eBay representative was actually a fraudster, attempting to launder illegal funds by manipulating Jessica and Sarah into unknowingly participating in the crime. Authorities received reports about both individuals, and they successfully blocked the movement of the funds through the financial system.