Unlocking my phone, I clicked on a text from an unknown number. It read, “Do you have old frozen pensions? Would you like to transfer them into a high-return investment and receive an immediate cash gift?” I must have re-read it ten times. Despite the unusual nature of this unsolicited message about my pension, all I felt was relief. It seemed like a lifeline.

Looking back, I now know I should have been more cautious. Ignoring that text and deleting it immediately would have prevented what followed. But I didn’t. I believed I was making a sound decision. That’s how, in 2013, I lost my entire pension pot of £45,000 to a pension scam.

Trusting the Wrong Person

You might wonder why I trusted someone I didn’t know, promising something that seemed too good to be true. It wasn’t that simple. Life was hectic, and financial pressures were mounting. I was approaching my 50th birthday, working full-time as an NHS nurse, and raising three teenagers. My parents were also seriously ill—my mum had terminal heart failure, and my dad had Alzheimer’s.

So, when I received a message offering an immediate cash bonus for transferring my pension pots into a high-return investment, it felt like an answer to my prayers. An extra £4,400 from two transfers would allow me to take time off work to care for my mum in her final weeks. The high-return investment promised to transform my retirement, letting me reduce my hours sooner and ease out of work gradually.

The Pension Scam Unfolds

Before getting carried away, I needed more information. I contacted the ‘company’ that sent the text. Speaking to ‘Tony’ over the phone, I felt at ease. He said, “These pensions are clearly not working for you. You could get a good return for this money.” He answered all my questions confidently, seeming intelligent, genuine, and trustworthy. So, I trusted him.

In February 2013, two weeks after receiving the initial text, I transferred money from one of my workplace pensions into the scheme. It was easy; I just contacted my two pension providers for the paperwork and sent it on. Within a week, I received a cheque for £2,500—10% of my initial £25,000 transfer. I felt immediate relief. While it wasn’t enough to tide me over for long, it helped me pay my mortgage and take time off to care for Mum. Convinced I was dealing with a reputable company, I transferred a second pension pot. This time, I invested £19,000 and received £1,900. Sadly, Mum passed away a few weeks later. Life continued, and I almost forgot about the investment scheme.

A Harsh Reality

Over a year later, I received a letter from The Pensions Regulator, a public body protecting workplace pensions in the UK. They had appointed professional trustees to take over my pension scheme. Their investigation revealed that the company I’d invested in didn’t exist. I had fallen victim to a pension liberation scam, losing my £45,000 forever.

I had been a nurse for 40 years, working hard to provide for my family and save for a comfortable retirement. Now, I had nothing. I felt ashamed and foolish for believing these fraudsters. They took my money, my future, and my hope. The worst part was telling my children. They understandably asked, “What will you do when you retire?” I had to tell them the truth: I would have to work until I physically couldn’t anymore.

The Wider Impact

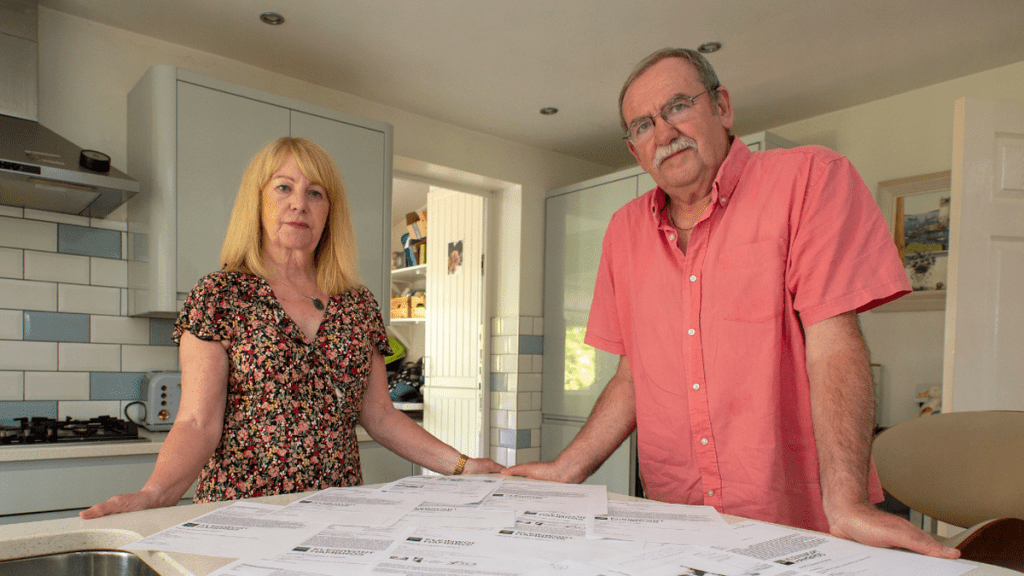

I wasn’t the only victim. Alan Barratt and Susan Dalton, the fraudsters behind the scam, stole from 245 other pensioners across the UK, totalling over £13 million. The Pensions Regulator initiated a criminal prosecution against them. In 2022, both were convicted of fraud and jailed. Barratt received five years and seven months, while Dalton got four years and eight months. Both were ordered to repay the stolen money with interest.

A claim for compensation is being processed through the government’s Fraud Compensation Fund. I will receive compensation through the pension scheme’s benefits. However, it’s still being determined how much or when it will arrive.

Lessons Learned

I’m much less trusting now. I wish I had never trusted that text message. But I have to keep moving forward, especially since stopping work isn’t an option. My advice to anyone considering transferring their pension pot is to stop and think. Never respond to unsolicited messages. Research thoroughly before making significant financial decisions. Taking five minutes to think things through might just save your future.

This experience has been a painful lesson in the importance of fraud prevention and fraud awareness. Pension scams can devastate lives, even for those who consider themselves savvy. Always verify the legitimacy of any investment opportunity, and be cautious with unsolicited offers. Protecting your financial future starts with vigilance and informed decision-making.