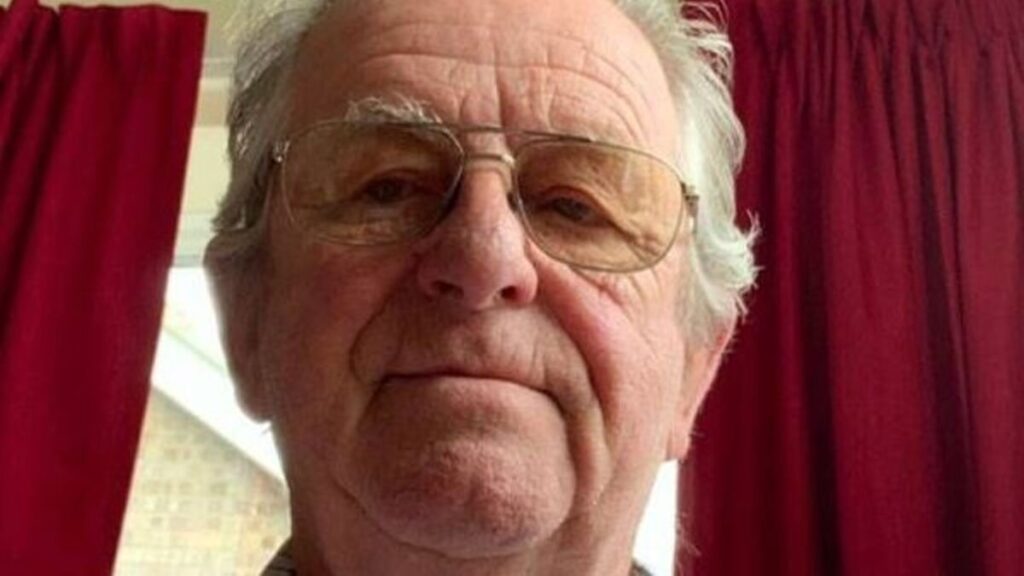

John Fillingham, an 80-year-old widowed grandfather from Clacton, faced a harrowing ordeal that left his emotional well-being shattered. Fraudsters, masquerading as representatives from his bank, tricked him into transferring £17,000. This episode took place during his move to North Yorkshire, a period that saw the exploitation of his vulnerability to its fullest extent.

John received a call loaded with security questions, a tactic designed to win his trust. The fraudster on the line convinced him that his money was under threat from an external attempt to access it. Despite harbouring doubts and failing to verify the caller’s legitimacy, John made two online transfers that totalled £17,000.

The Struggle for Resolution

John approached Santander, only to face the disheartening reality that they could provide no substantial help, aside from offering a free overdraft. The stark response, “I’m not covered; it’s my fault,” left him feeling abandoned and forced to confront the harsh policy alone.

As the world grappled with the pandemic and John faced a personal health crisis, the prospect of recovering his lost funds seemed increasingly distant. However, a glimmer of hope emerged when he encountered an advertisement for CEL Solicitors on the radio. Three years after the initial scam, John’s perseverance paid off, and he was able to recover his funds with added interest. “It feels like justice has been done,” he remarked.

A Close Call and Valuable Lessons

The ordeal took a significant toll, yet it also gave John the knowledge and determination to thwart future attempts. When fraudsters tried to trap him again using a similar scheme, John stood firm, promptly ending the call.

Paul Hampson, chief executive of CEL Solicitors, underscored the prevalence of such frauds. He emphasised the sophistication of the tactics employed by fraudsters to gain trust and advised the public to exercise caution. “If a number calls you claiming to be your bank, stop and think,” he suggested. Verifying the caller’s identity through official channels can provide a crucial safeguard against fraud.

Elevating Fraud Awareness and Prevention

John Fillingham’s story is a stark reminder of the emotional and financial devastation fraud can wreak. It underscores the importance of vigilance, fraud prevention, and the need for systemic support for victims. As fraudsters continue to refine their methods, public awareness and the dissemination of knowledge on how to combat these crimes are more critical than ever.

This narrative serves as a cautionary tale and a beacon of hope for those who have suffered at the hands of fraudsters. It illustrates the resilience required to navigate the aftermath and the significance of seeking justice, however daunting the path.

Being Proactive

Securing a refund from a bank can be a protracted battle, stretching over years, as illustrated by Mr Fillingham’s experience. The knowledge he gained, enabling him to fend off a subsequent attempt, underscores the power of awareness and education. Had this knowledge been in his arsenal before the first scam, Mr Fillingham could have sidestepped the financial loss and emotional distress that followed.

This highlights the paramount importance of taking proactive steps towards fraud prevention. Educating oneself and staying vigilant can dramatically lower the chances of becoming a victim. Mr Fillingham’s story serves as a poignant reminder of why it is crucial to arm oneself with knowledge and awareness. By prioritising these preventive measures, one can safeguard one’s finances and emotional well-being against the devastating impact of fraud.