With the rise in scams targeting high street banks like Santander, it is essential for consumers to stay vigilant and be aware of the latest phishing scams. One of the latest attempts is a highly sophisticated phishing scam, which can be difficult for the everyday Santander customer to spot. This article will discuss the latest phishing scam, the importance of reporting fraud, and how to stay safe.

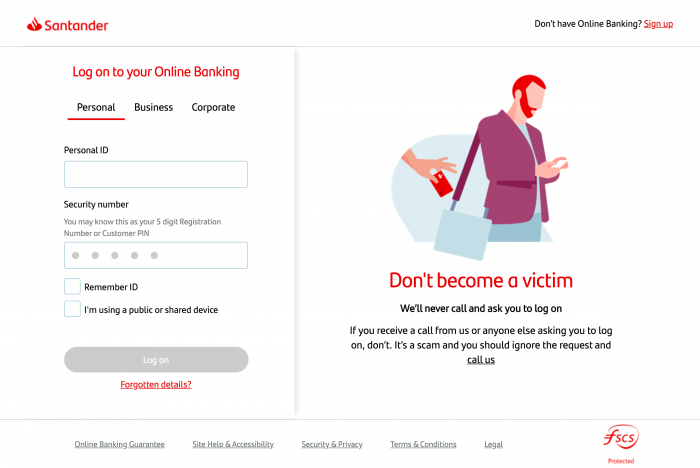

The latest Santander email scam involves pressuring customers to update or confirm their contact details. The email looks authentic, carrying all the standard colours, layouts, fonts, and phrases that are usually included in genuine Santander emails. The email instills a sense of urgency, tricking victims into clicking a link that redirects them to a counterfeit website, closely resembling the authentic Santander page. Fraudsters then harvest any information entered on this site, using it for various criminal activities.

Understanding the Threat

Once on this fraudulent site, the scam prompts customers to update or confirm their contact details. When customers unknowingly input sensitive information like login credentials, phone numbers, or addresses, fraudsters actively capture this data. Fraudsters then use the harvested information for various criminal purposes, including identity theft and financial fraud. This scam is particularly dangerous because it exploits customers’ trust in Santander’s communications.

Like many banks, Santander frequently reminds customers that they would never solicit sensitive information via email. Consumers need to double-check the sender’s email address, look for any inconsistencies in the email’s content, and avoid clicking on links or attachments from unknown or suspicious sources. In the event of receiving such an email, it is imperative to report it immediately to Santander’s fraud prevention team to help stop these scammers in their tracks.

Key Signs of a Phishing Scam

To avoid falling victim to this type of scam, it is crucial to be aware of the key signs of a phishing scam. Some of these include:

- An email that does not address you personally using your full name.

- An email from a sender’s address that is different from the one used by your bank for regular emails.

- An email that creates a sense of urgency and pressure to click on a link.

- An email that asks for personal or sensitive information.

It is also essential to remember that banks like Santander will never ask for personal or sensitive information via email. If you receive an email that asks for this type of information, it is likely a phishing scam.

Stay Safe and Protect Your Information

To stay safe and protect your information, it is crucial to follow these steps:

- Do not use links provided in an email. Always log in using the bank’s official website.

- Report any suspicious-looking emails to [email protected].

- Educate yourself on the latest fraud prevention techniques.

- Stay alert to any potential phishing scams.

The Importance of Reporting Fraud

Staying vigilant and reporting fraud is essential in curbing the spread of phishing scams. Moreover, fraudsters continually devise new and sophisticated methods to deceive consumers into surrendering sensitive information. Consequently, by reporting cases of this Santander email scam, individuals enable the authorities to track down and apprehend the culprits, thereby preventing similar email scams in the future. This proactive approach is crucial in maintaining online safety and security.

Fraud prevention is crucial in today’s digital age, and it is up to us as consumers to stay alert and report fraud. Whether you are a customer of Santander or any other bank, always be cautious when receiving emails and never click on links from unknown sources. By following these tips and staying informed, you can protect yourself and others from becoming victims of phishing scams.