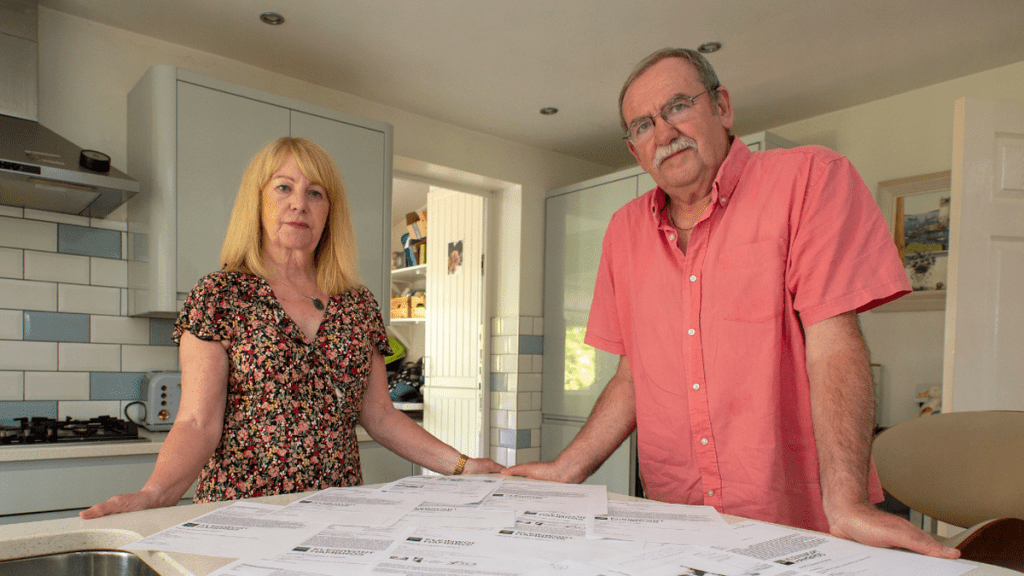

The Morgans, a couple from the UK, were victims of a sophisticated investment scam that cost them their entire £100,000 savings. The scam started when they searched for investment ideas online, leading them to what they believed was the well-established private bank Kleinwort Hambros. However, the website was a clone set up by fraudsters.

After several months of communication, the couple invested their savings in what they thought was a one-year fixed-term bond. But the scam unravelled when the phone number and email address provided by the so-called “investment advisor” stopped working.

Upon realising they had fallen victim to a scam, the Morgans contacted TSB, their bank for over 40 years, seeking help in recovering their money. Despite admitting they never sent any fraud alerts, TSB denied liability for the losses and refused to provide a refund.

TSB Denies Refund to Investment Scam Victims

Determined to get justice, the couple took their case to the Financial Ombudsman, who ruled in their favour after a thorough investigation. The Ombudsman stated that the transfers made by the couple should have raised suspicion at TSB, and contact should have been made to discuss the dangers of investment fraud schemes.

However, TSB appealed the ruling and the Ombudsman reversed the decision, stating that the victim was not an experienced investor. But decided that even with fraud warnings, he would have ignored them due to the sophisticated nature of the scam. The bank admitted that they should have intervened, but the victim’s belief in the legitimacy of the “investment” would have overridden any fraud alerts.

This case highlights the importance of fraud prevention and the need for due diligence. Impersonating a trusted financial institution is a common tactic used by fraudsters to gain the trust of potential victims. A quick internet search would have revealed the authentic contact information for Kleinwort Hambros. Preventing the couple from falling prey to the scam.

The Danger of Investment Scams

Investment scams are becoming increasingly extremely sophisticated. It is essential to stay vigilant and protect yourself from these fraudulent activities. The best way to prevent becoming a victim of investment fraud is to be proactive and do your due diligence.

Before investing in any opportunity, be sure to research the company and verify its authenticity. Search for reviews, read their terms and conditions and check their registration with the relevant regulatory bodies.

In case of suspicious activity, always trust your instincts and report it immediately to the relevant authorities. If you believe you have fallen victim to a scam, contact your bank and report it to Action Fraud, the UK’s national fraud reporting centre.

Why Your Personal Information Is So Valuable

Investment scams often involve the theft of personal information, so it is essential to take precautions to protect your identity. Please keep your personal information secure by never sharing it with anyone online or over the phone unless you are confident of their authenticity.

Regularly monitoring your financial accounts and credit reports for suspicious activity is also a good idea. If you notice any unauthorised transactions, report them immediately to your bank and the relevant authorities.

Fraud prevention is a shared responsibility. The UK government and financial institutions have a role to play in educating the public on the dangers of investment scams. This can be done by providing the necessary tools to protect themselves. At the same time, individuals need to take responsibility for their financial security by staying informed and taking the necessary precautions to prevent fraud.