Recently, the financial industry has been profoundly impacted by various escalating fraud trends. Synthetic Identity Fraud (SIF), an intricate and advanced form of fraud, stands out as the most potent threat to financial security we’ve seen in recent years. Its prominence increased during the global pandemic. The practice involves crafting an entirely new identity by interweaving both legitimate and fabricated personal details stolen from several victims.

Understanding Synthetic Identity Theft

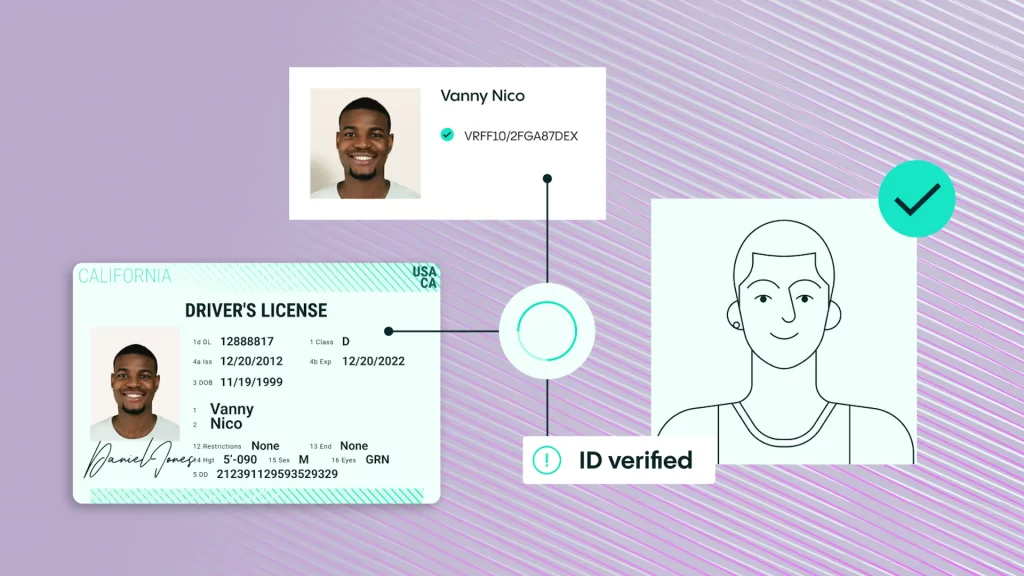

SIF unfolds when an impostor devises an entirely new identity by blending real and fabricated personal details, typically pilfered from diverse sources. This newly-created identity doesn’t correspond to any existing person. Fraudsters exploit this identity to secure credit, benefits, or other amenities. Genuine details camouflage the fraud, while fabricated information obscures the perpetrator’s tracks. The synthetic identities creation method allows fraudsters to circumvent current fraud detection models and quickly establish credibility.

A new identity under SIF is established by merging genuine and fabricated personal details. Fraudsters often pair a legitimate date of birth (DOB) with a counterfeit name and address to formulate a new identity. The legitimate DOB facilitates the perpetrator to elude preliminary identity validation checks, while the false name and address ensure the scammer’s track remains untraceable.

How Does SIF Work?

Post creation of the synthetic identity, the fraudster starts establishing a credit profile. The fabricated identity is employed to request credit-centric products like credit cards, loans, or mobile phone contracts. Even if the application is rejected, a credit investigation ensues, aiding the development of the synthetic identity’s credit history.

Fraudsters leveraging SIF are savvy and patient. Over months, they nurture the synthetic identity via regular payments, establishing direct debits, and setting up standing orders. Upon establishing a robust credit profile and gaining trust with banking institutions, applications for valuable financial products like loans are initiated.

Given the synthetic identity’s established status within the system, alongside a solid credit history and appropriate spending patterns, the likelihood of approval for a high-value loan or credit card is exceedingly high, particularly when applied with an institution already linked to the synthetic identity.

Guarding Against this Emerging Threat

Guarding oneself against SIF is arduous due to the difficulty in detecting such fraud. Nonetheless, there are strategies to mitigate the risk of becoming a victim:

- Safeguard Personal Information: Ensure your personal details, like your date of birth and address, are secure. Avoid sharing such information online or via phone, only divulging it to trustworthy sources.

- Credit Report Monitoring: Regularly scrutinise your credit report for unusual activities like unfamiliar credit accounts or unrequested loans.

- Beware of Unsolicited Offers: Exercise caution with unsolicited credit card or loan offers, especially from unknown sources.

- Report Suspicious Activity: Report any dubious activity on your credit report immediately to the credit bureaus and your bank.

- Use Identity Theft Protection Services: Contemplate identity theft protection services that monitor personal information and alert you to unusual activity.

Synthetic Identity Fraud poses a significant threat to the financial sector and has emerged as a principal fraud trend during the pandemic. The unique nature of SIF, crafting a new identity by blending genuine and fabricated personal details, presents a unique challenge for detection and prevention.

Yet, financial institutions equipped with the appropriate technological solutions and high-quality data can counter this growing menace. With intelligent systems capable of real-time SIF detection and enhanced identity verification, banks and other financial organisations can provide better protection to their clientele and the broader financial industry from the catastrophic effects of SIF.