Smishing is a type of scam in which fraudsters use SMS (text messages) to trick individuals into divulging sensitive information or making payments. This type of fraud can lead to significant financial losses and serious personal security risks.

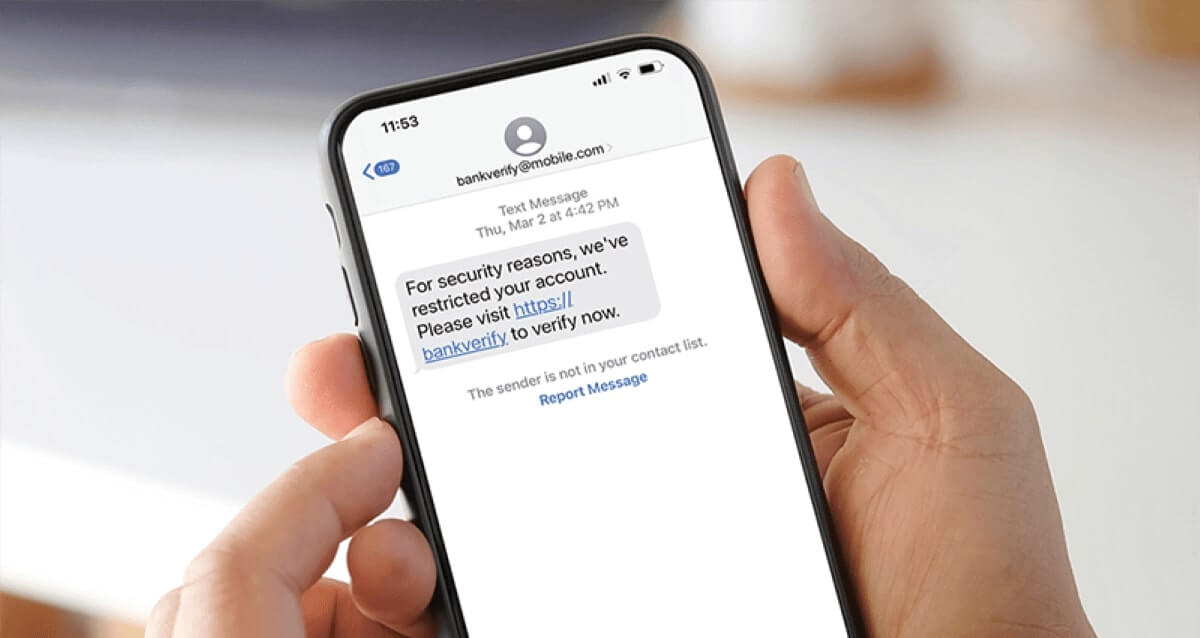

Smishing combines the terms “SMS” and “phishing” and represents the mobile equivalent of email phishing. Scammers send fraudulent text messages that appear to come from trusted sources, such as banks or government agencies. They aim to lure you into clicking a malicious link or providing confidential personal or financial data.

Understanding the typical stages of a smishing attack can help you identify and avoid these scams. Here’s a breakdown of the process:

The consequences of falling victim to a smishing scam extend beyond immediate financial loss. Here’s how smishing can affect you:

Being able to identify smishing attempts early is your best defence. Here are some key red flags to watch out for:

Proactive measures are crucial to defending against smishing scams. Follow these practical steps to protect your personal and financial information:

If you believe you have fallen victim to smishing, prompt action is essential. Follow these steps immediately:

Smishing is a serious and growing threat in 2025, targeting millions of individuals each year. The scam can lead to significant financial losses and compromise your personal security, making it crucial to remain vigilant and proactive in protecting your data.

Your awareness and proactive measures are the best defence against smishing. By taking these steps, you can safeguard your personal and financial information and stay one step ahead of fraud.

November 22, 2023

In a significant win in the fight against fraud, Waterford police have made nine arrests, smashing an international smishing ring in the process. This move comes amidst an international probe…

September 16, 2024

With student loan payments rolling in, fraudsters often attempt to steal these funds using scams like smishing. Last year alone, millions of pounds were saved from fraud attempts, but the…

December 5, 2024

As millions of Brits prepare for the festive season, fraudsters are gearing up too. With an increase in online shopping and holiday cheer, fraudsters exploit this time of year to…

Watch Your Pocket is a team of experts dedicated to raising fraud awareness and equipping individuals with the knowledge and tools they need to protect themselves.